How WallStreetBets took GameStop “to the moon” – the $GME stock saga, as it happened

Shutterstock

ShutterstockThis time last year, GameStop shares — “$GME” on the stock market — were worth $4.13USD a piece. Almost exactly a year later, just one of the dying game store’s shares spiked at an incredible $492.02 each. Here’s how WallStreetBets looked to ‘beat’ their Wall Street counterparts, and in the process, sent their investments “to the moon.”

The entire internet has been awash with one thing this week: video game retailer GameStop, or rather “$GME,” and how a group of meme-powered internet investors in the /r/WallStreetBets subreddit guided its shares to an incredible 11,913.3% spike.

The “$GME” saga didn’t happen overnight though. Sure, it was helped on through recent twists in the tale (Elon Musk jumping on board, the mainstream media picking it up, and Wall Street finally taking notice), but this has been a story months and months in the making.

Here’s how more than two million self-described “morons” on a Reddit trading page largely dedicated to memes sparked GameStop’s wild ride — as it happened.

Facebook: GameStop

Facebook: GameStopContents:

- What is a “short-squeeze”?

- Meet the ‘heroes’: /r/WallStreetBets

- GameStop stock explodes — how it happened

- Sep, 2019: Burry’s Scion presser

- Apr, 2020: “Biggest short squeeze of your life”

- Aug, 2020: Ryan Cohen reveals $5.8m stake

- Sep, 2020: 70% of shorts “underwater”

- Dec, 2020: $GME climbs to $19.26

- Jan 14, 2021: We have liftoff

- Jan 25-27, 2021: The $GME investment goes viral

- 8am, Jan 27, 2021: “Gamestonk!!”

- 5pm, Jan 27, 2021: /r/WallStreetBets goes dark

- Jan 28, 2021: $GME hits $469 high

- Jan 29, 2021: Trending down?

- So what happens next?

What is a “short-squeeze”?

This won’t take long, but to understand the story, you must have an idea of “shorting” stocks, a “short-squeeze,” and why it played such a big role in the still-unfolding GameStop saga.

First, “shorting” a stock basically means betting on them going down. A short-seller will borrow shares from one party, and sell to another. When the price falls, they buy back those shares — at a cheaper price — and return them to the original owner.

Then, a “short-squeeze” is when the gamble doesn’t pay off. If the stock begins spiking again, short-sellers have to buy back in to avoid owing more on what they borrowed. That, in turn, causes the price to climb even higher than it may have originally without the push.

- Read more: TheStockGuy explains $GME in simplest way

Note: GameStop was the most shorted stock on Wall Street this year.

Paramount Pictures

Paramount PicturesMeet the ‘heroes’: WallStreetBets

Enter /r/WallStreetBets. At this stage, the popular Reddit forum is just a touch under two million strong, and regularly chasing easy money on penny stocks and punts.

The phrase “going to the moon” is a big one in WallStreetBets.

There’s also rocket ships, “diamond hands,” and a number of less than publishable slurs that are thrown around on the subreddit that worships the ‘Wolf of Wall Street’.

Users will post their long-term punts — and short term losses — for the masses to critique, laugh at, or even join in on. Obsessions like “SPY”, “YY”, and “TSLA” regularly pop up for weeks at a time, with the whole forum pushing the shares.

18 months ago, a new contender emerged: “$GME.”

There were plenty of doubters over the stock, and fair enough. The brick-and-mortar video game store was being choked out by online purchases, and struggling to stay afloat.

- Read more: AOC addresses GameStop stock drama on Twitch

On Sep. 8, 2019, however, the first turn of the wheel happened. ‘DeepF**kingValue,’ a user on the forum, revealed he had invested $53,566 in GME. He was called a few less than savory things, but he stuck to his beliefs. And, he delivered what turned out to be a very prophetic message.

“This is just the beginning.”

Screenshot via Reddit

Screenshot via RedditGameStop stock explodes — as it happened

September, 2019

($GME at $4.41)

Fast-forward to mid-2020, and /u/DeepF**kingValue has already seen a spike in his $GME stocks. He came back talking (not really boasting) about his “tendies” — WallStreetBet’s word for profits, referencing chicken tenders — and more eager, interested Reddit investors took notice.

The reason? Burry’s Scion released a presser urging GameStop to buy back $23m in shares. Equally, Seeking Alpha suggested shorting the shares was a mistake.

WallStreetBets wasn’t quite sold yet, even with GME’s first spike.

April, 2020

($GME at $4.74)

Half a year later, there had been very little movement for GameStop. It hadn’t dipped, even as the world went into lockdown, but wasn’t growing either.

Until another post appeared on /r/WallStreetBets.

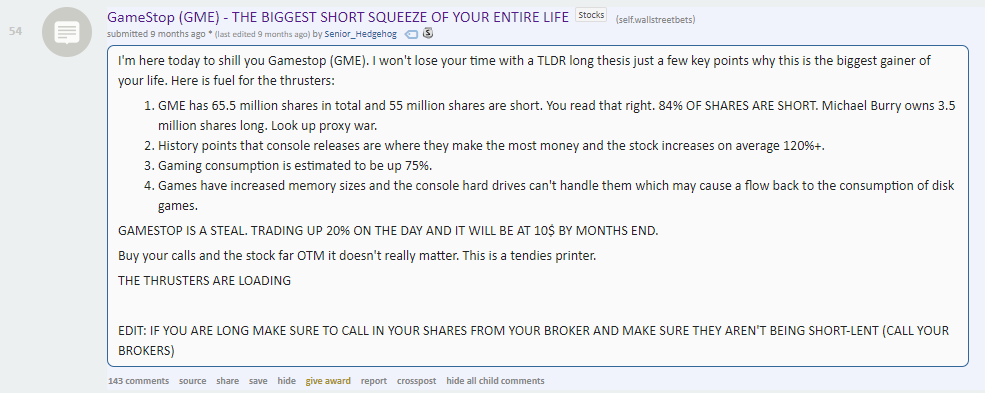

The self-proclaimed shill from Senior_Hedgehog sold a simple gamble: “The biggest short squeeze of your entire life.” According to the Redditor, 84% of GameStop’s stocks had been held short by Wall Street investors. It was a chance to take the “war” to short-sellers.

The April 13 post began a slow roll. The shares lifted 22% that day, and another 26% the next. It was an 18-year record for GME.

Screenshot via Reddit

Screenshot via RedditAugust, 2020

($GME at $5.39)

And now we come to the turning point. DeepF**kingValue had been around for some time, mainly posting GIFs and warding off doubters.

Hedgehog had done his part too, but it was just a rustle.

On Aug. 31, however, Chewy Inc co-founder Ryan Cohen disclosed a 5.8m share stake in GameStop through his RC Ventures. A 24% surge followed soon after.

September, 2020

($GME at $8.75)

One final push came in the final months of 2020. A post, “Bankrupting Institutional Investors for Dummies, ft GameStop,” laid out the new plan: it wasn’t just about making “tendies” for /r/WallStreetBets anymore. It wasn’t (totally) about going “to the moon.”

Redditors had seen a chance to stick to short-sellers and big-time investors. 70% of shorts were already “underwater” (not making a profit anymore).

The “biggest short squeeze” was on its way.

December, 2020

($GME at $19.26)

By the end of the year, the explosion was in full effect. $GME has rocketed to $19.26. And it wasn’t done; January was right around the corner.

Screenshot via Commsec

Screenshot via CommsecJanuary 14, 2021

($GME at $39.91)

The climb really began in mid-January. GameStop shares had already begun rising, with $4 up to $20 a fantastic surge, but /r/WallStreetBets, and DeepF**kingValue were far from done.

There was one rallying cry: “HE’S STILL IN, I’M STILL IN.”

January 25-27, 2021

($GME at $76.79, to $351.94)

Here, the saga goes viral. The WallStreetBets war had been simmering away for weeks, and hardened “morons” on the subreddit had been following closely for any scraps on when to buy in, when to double-down, and when to sell.

On January 25, however, the internet weighed in. The price explosion went truly viral. Mainstream media began reporting on the story, and that in term brought in more and more investors eager to grab a slice of the pie while it was still hot. Stocks began to rocket, and the $76.79 began to climb rapidly.

- January 25, $GME closed at $76.79

- The next day, $147.68 was the stock’s top spike.

- Then, Wednesday toppled that ($351.94).

The $GME was well and truly on its way “to the moon,” and nearly $500.

Reddit

Reddit8am, January 27, 2021

($GME at $351.94)

“Gamestonk!!”

It was a simple tweet from Elon Musk amid all the GameStop excitement, but one that helped keep the momentum going. The share had dipped down to $301, before a $44 surge thanks to the Tesla guru. Any threats of an early dip faded away.

Gamestonk!! https://t.co/RZtkDzAewJ

— Elon Musk (@elonmusk) January 26, 2021

7pm, January 27, 2021

($GME at $335.82)

/r/WallStreetBets goes dark. The subreddit moderators took the forum offline for more than an hour, mentioning they were “suffering from success.”

The subreddit, which now boasts over 5.38m followers as of publication, did come back online soon after. It was flooded with memes, cries to “HOLD!” and praise for those that had stuck through the dips and their “diamond hands.”

Around the same time, the /r/WSB official Discord was banned for “hate speech.”

GameStop stock, $GME has just reached over 300, with a total market cap of over $21 billion, as Reddit day traders continue to send the price soaring… pic.twitter.com/ithyG1yrwt

— Dexerto (@Dexerto) January 27, 2021

January 28, 2021

($GME at $469.42)

The next day, GameStop would go on to hit its highest peak yet — a $469.42 high that it hasn’t been able to replicate since. This seems to have been “the moon.”

Trading app Robinhood has halted trading on GameStop, AMC, Blackberry and Nokia, stating "This stock is not supported on Robinhood."

This is as GameStop stock continues to surge. pic.twitter.com/3mQ6zaeUfy

— Dexerto (@Dexerto) January 28, 2021

January 29, 2021

($GME at $197.44)

Sellers have begun throwing their weight around on the market. A sharp dip to open the market on January 29 has seen the $GME stock slide as low as $193.60. According to his daily “YOLO” update post, DeepF**kingValue lost over $13m worth of value in 24 hours.

And that brings us to the current day, where $GME is a smidge under $200.

Screenshot via Google

Screenshot via GoogleSo what happens next?

Unfortunately, for now, it looks like the bubble may have burst. There’s already crack-downs coming from Wall Street — which /r/WallStreetBets is less than pleased about — and popular trading app Robinhood has restricted trading, leading to a huge dip in price.

There’s still plenty to come in the GameStop saga, however. WSB has declared the plan far from over, and DeepF**kingValue has more call options up to April 2021 (his last were on January 15, right before the spike). He’s “still in.”

High-profile politicians, like Alexandria Ocasio-Cortez, are also beginning to wade into the issue. Paul A. Gosar has even gone as far as calling for “an immediate investigation” into Robinhood, and its hedge fund owner, Melvin Capital.

For now, it seems like GameStop got it right 40 years ago when they first started their marketing campaigns: it really is “power to the players.”