missharvey column: Valve, wake up before it’s too late for CSGO (Part 1)

ESL

ESL

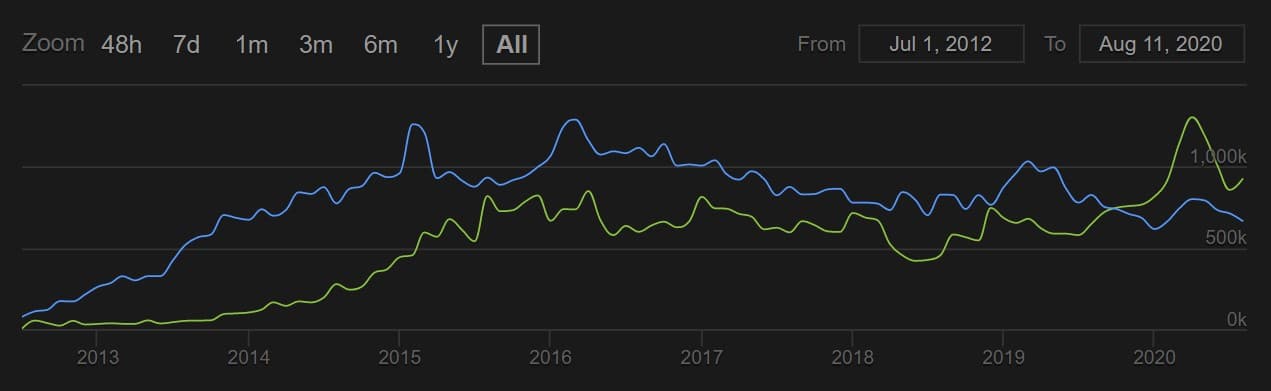

Before delving into the nitty gritty, I want to preface this by saying that Counter-Strike from a developer standpoint is prospering. In April 2020, CS:GO hit an all-time high of over 1.3 million concurrent players — averaging over 850,000 for that month alone. However, from a community point of view, you wouldn’t know it. I often worry for the future of CS:GO and get pretty upset from the lack of freshness coming out of the game; its gameplay might be as good as any CS game ever was, but the boredom and the burnout is growing day by day.

Undoubtedly, Counter-Strike has gone from strength-to-strength since its humble beginnings as a Half-Life mod. But we’re now approaching the eighth year of CS:GO’s life — the majority of which has been spent setting the example for what a competitive first-person shooter should look like — and CS is falling off the wagon.

Who’s at fault, you ask? The game developers. Yep, I strongly believe it is the game dev’s responsibility to cherish its product and its community, renew their experience, bring in new players and strive to make the scene better. Evolve or fall behind. Fortunately for Valve, there hasn’t been an S-tier shooter to compete with CS:GO during its tenure at the top. But the landscape of competitive gaming is changing, and other game companies are learning fast. On top of it, since its peak earlier in 2020, CS:GO’s player base is on a steady decline, and this should be a wake up call for Valve to take swift action. They should nurture CS if it wants to stay competitive in the field of new and shiny FPS esports titles.

Steamcharts

SteamchartsCSGO is still the greatest FPS esport

Despite all of its inherent flaws (which we’ll go into later), CS:GO is the gold standard for what a first-person competitive shooter should strive to be. At its core, the mechanics are sharp and precise, and every other feature in the game complements it to make this perfectly balanced cocktail. But aside from doing the basics to an unrivaled standard, there’s something else which helps CS:GO shine where others often fail… the game’s tension curves.

Scaling both the difficulty of the game and the emotional input and wrapping into one neat package is something CS:GO does almost effortlessly. At the start of the round, you and your team make a tactical decision on what to buy based on a number of variables (economy status, the enemy team etc.), after which, the round plays out until a critical point. This is where the difficulty of the game is ramped up (enemy applies pressure) and you either overcome the stimulus or fail.

It’s at this critical point where you’re most invested in the game from an emotional standpoint, and the outcome will determine the emotive response. “Yay, we made the right decision and won” = euphoria… Or “Damn, Purple, you lost us the round” = disappointment. Either way, you’re hooked because the game’s difficulty is relative to your response and is scaled according to your input.

It’s not all sunshine and rainbows

But while there’s no doubt that Valve have mastered the art of enthralling gameplay, CS:GO is at a stage where it simply needs more. For decades, that ‘more’ came from us, the community. We invested the money, hosted the tournaments, made the mods, improved the websites, played in our leagues, created our launchers, provided the content, just name it. We made sure WE nourished our favorite game by investing in OUR community. Valve didn’t support us? It’s ok, we had the best game in the world back!

However, with how rapidly competitive gaming is changing and how massive it is becoming, this is no longer something that is sustainable. This push also has to come from the developers as well. And in this case, to be quite frank, Valve seems about as passionate about CS:GO as I am about carrots. I like carrots, they are good, but I can’t recall a time I was actually excited to eat a carrot. What we need is a Valve that cares. In comparison, take Riot Games for example… While yes, Valorant is still in its infancy, the developers have been extremely transparent about their plans, and have taken community feedback on board in a bid to improve the game.

And I don’t think this is just the honeymoon phase of having a ‘new game’ — it’s deeper than that. This micro-level passion reflects in what is an extremely well-thought-out game. In fact, Valorant is the first game that has made me feel the way I did when I first played Counter-Strike. Riot have taken a leaf out of Valve’s book — when it comes to replicating those tension curves — with their flagship Spike Defuse game mode. Adding Agent abilities and well-balanced gunplay to this just adds another layer of excitement.

So with all that said, isn’t it time that Valve looked at how Riot has approached Valorant’s community for answers and, most importantly, listened to their feedback? I actually feel as if Valorant’s dev team is listening more to Counter-Strike players than Valve itself. There have been a lot of times in my career where I wish Valve showed us more, and once again we seem to be at a crossroads. They have everything they need to stay on top, but seem to be happy to just sit back and let other games play catch-up. I mean, c’mon, 64-tick competitive servers in 2020?

Riot Games

Riot GamesIs Valve countering Counter-Strike?

From an esports perspective, I’d argue that there isn’t another game out there that can offer the level of spectator intensity that CS:GO does; the millions of people tuning into Majors and the sold-out arenas attest to that. So with that said, why aren’t Valve investing in that scene? Sure, we have our majors, and they offer in-game cosmetics or Pick ‘Ems to ramp-up interaction… but those are getting tiring and there’s so much more that can be done.

Away from the bright lights of the Major-tournament stage, there’s a thriving, organic scene that goes unrecognized to the masses. What’s keeping that alive? At the moment, it is tournament and league organizers. Outside of our 2 majors a year, the likes of ESL, DreamHack, BLAST, etc. are responsible for everything when it comes to running pro events (from the prize pool to player travel) and FACEit, ESEA, etc. are making sure the amateur scene doesn’t starve to death.

I’ve never been in favor of a franchised model, but more developer input and in-game integration would place the existing community up on a pedestal. We need up and coming players to feel supported, while enticing casuals to engage more with the esports aspect. Imagine a world where Valve embedded a ‘Path to Pro’ system into the game, which rewarded the grind. Awww, dreaming.

Riot Games

Riot GamesQuite frankly, Valve is so lucky to have CS:GO — there’s a reason why other titles in the space attempt to replicate everything that Counter-Strike does well, and often fail at doing so. It is really unique and its ever-faithful community is so hungry for support that as soon as we get the smallest gifts, like hats on chickens, we go crazy. Our community is not asking for much, but rarely gets anything given back. I think we should be asking for a lot, and get a lot more in return.

In the next part, I’ll be outlining an in-depth view of exactly what Valve can do to take CS:GO to new heights, given the topics we briefly touched on above. Even after all this, I have not lost hope in Valve and believe they can still wake up, before it’s too late.

Stay tuned for the second part of missharvey’s debut column, where Stephanie will outline some potential solutions for the issues detailed above.