Activision Blizzard took mind-boggling amount from US taxpayers in 2018

Blizzard Entertainment

Blizzard EntertainmentBlizzard quickly fixed their mistake, but not before we were able to get screenshots.

Video game publishing giant Activision Blizzard reportedly managed to not pay any United States federal income taxes in 2018, and even got a nice kickback from the federal government on top of it.

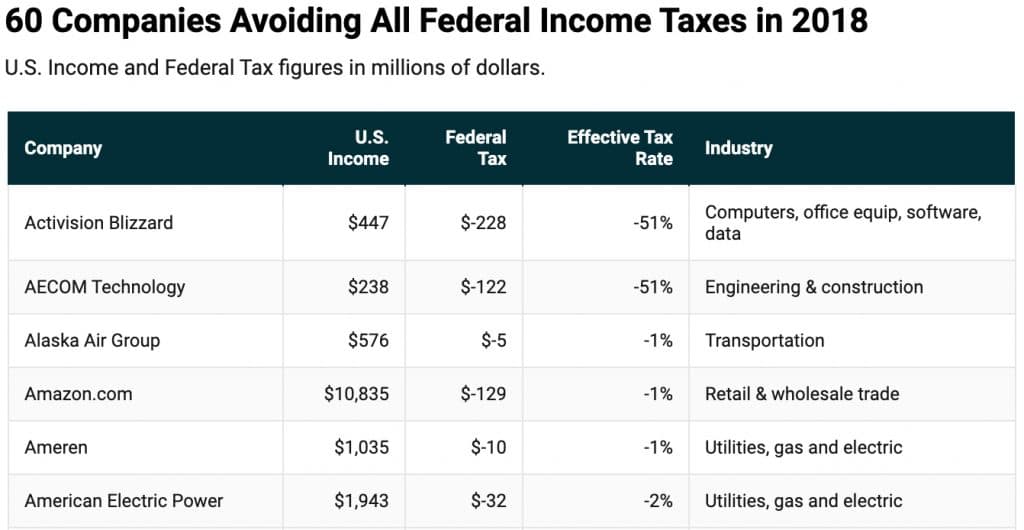

A new report from the Institute on Taxation and Economic Policy (ITEP) listed 60 of the top companies in America that didn’t pay any federal income tax for 2018.

Activision Blizzard is one of the first companies named, but the list also includes Amazon who owns the popular streaming platform Twitch.

[ad name=”article1″]

ITEP said that the companies in the recent report appeared to be “using a diverse array of legal tax breaks to zero out their federal income taxes.”

According to the report, Activision Blizzard raked in $447 million in listed income for 2018, but paid no income tax and ended up getting $228 million in tax rebates, courtesy of US taxpayers.

To look at it another way, the company managed to receive a -51% tax rate, which means their rebate was more than half of the listed income for the company in 2018.

Activision Blizzard and Amazon were among the 60 listed companies to pay no federal income tax in 2018.

Activision Blizzard and Amazon were among the 60 listed companies to pay no federal income tax in 2018.[ad name=”article2″]

Amazon, who brought in over $10 billion during 2018, didn’t pay any federal income tax either, but only received a paltry $129 million kickback – a roughly -1% tax rate.

Twitch was purchased by Amazon for $970 million in 2014, which makes it tough to distinguish the streaming platform’s revenue from that of its parent company.

It’s crazy for many to think about how that these companies brought in so much money and didn’t have to pay a cent in federal income taxes – but under the current system, it’s all completely legal.

We don’t know exactly how much money Twitch brought in for 2018, but Amazon seems to have done just fine.

We don’t know exactly how much money Twitch brought in for 2018, but Amazon seems to have done just fine.[ad name=”article3″]

According to ITEP, both Activision Blizzard and Amazon were able to reduce their income taxes in part by using what’s called a “tax break for stock options.”

“This tax break allows companies to write off stock-option related expenses in excess of the cost they reported to shareholders and the public,” ITEP explained in their report.

Amazon was able to reduce its income taxes by more than $1 billion in 2018 using the stock options tax break, and Activision Blizzard reported $58 million in tax breaks from the system, along with another $46 million tax credit for “Research and Development.”

Activision Blizzard is on track for another good year in 2019, with the company reporting on December 18 that the newest Call of Duty: Modern Warfare title has brought in over $1 billion so far.

It will be very interesting to critics to see what federal income taxes if any, they end up paying in 2019.